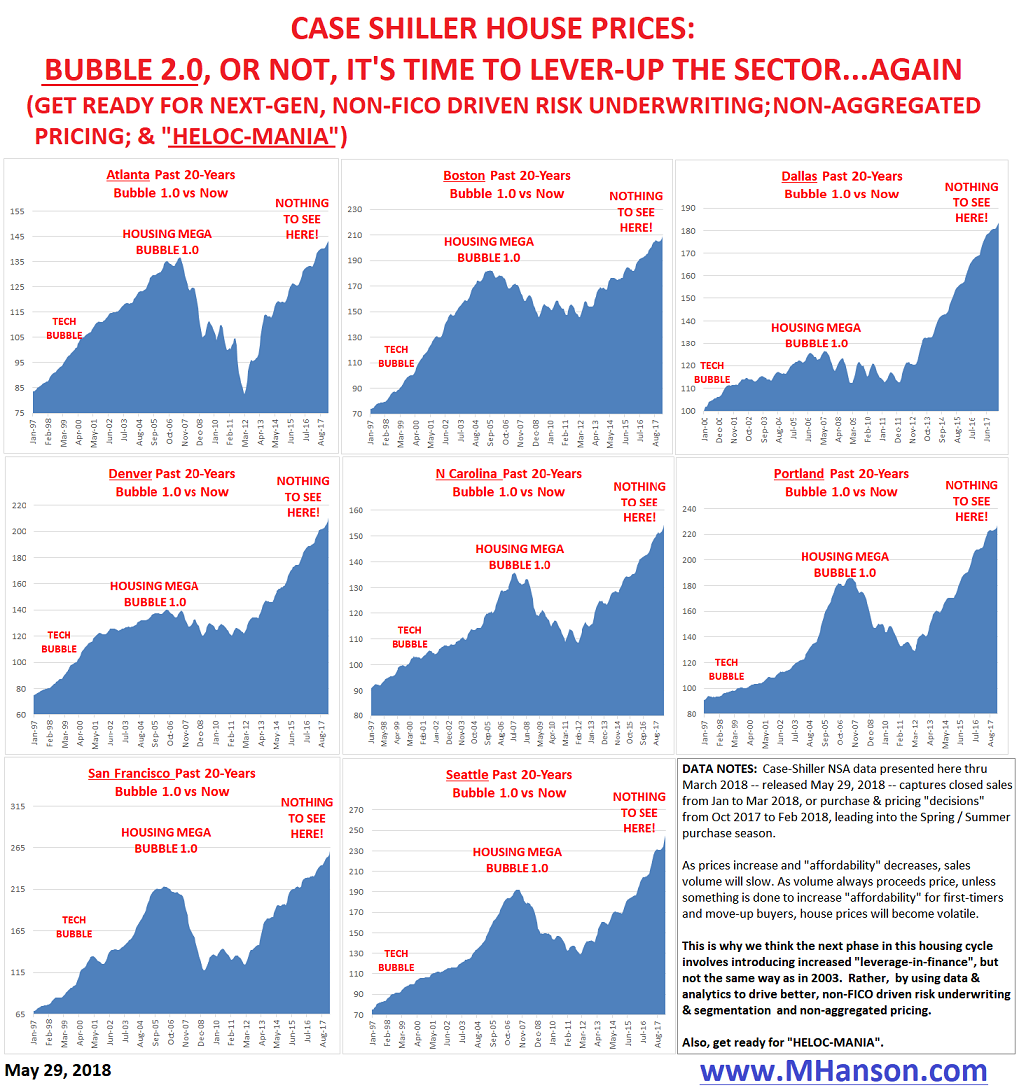

House Prices; BUBBLE 2.0, OR NOT, It’s time to Lever-Up the Sector…Again

This week’s Case Shiller revealed prices in the 20 rose at the fastest pace since ’14. Further, ALL 20 major regions showed gains with Seattle up 13%, Vegas 12% and SF 11%yy.

This is so out of scope relative to income & the direction of rates the only comp is 2002-07.

…With refi vol at 18-yr lows, prices soaring like it’s 2004 again, rates rising (also like 04 again), wages lagging, the avg down payment less than 6%, and all big donation housing / lending lobbies interested in keeping house prices and volume heading north in perpetuity, something will be done to increase “affordability” across the board; first timers, repeat buyers, investors and refinancers.